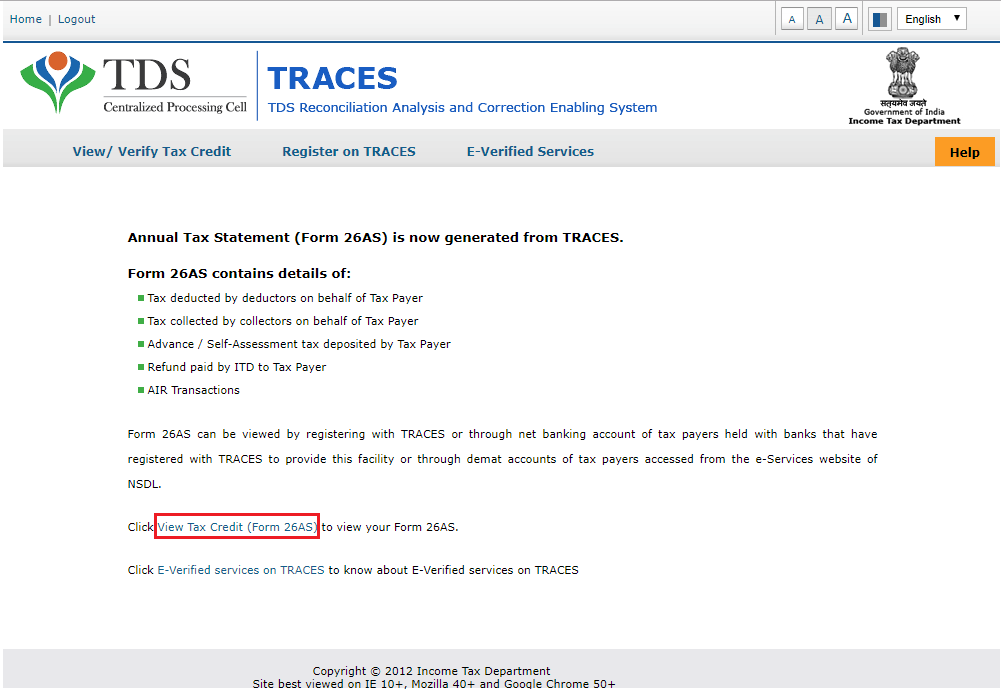

Online Bank Account Option 3: There are various ways to view one's tax credit. Get instant notifications from Economic Times Allow Not now. Read more on TDS. You should always view form 26AS before filing your Income tax Return. Never miss a great news story! The form will be displayed and can be downloaded.

| Uploader: | Mer |

| Date Added: | 3 September 2010 |

| File Size: | 13.2 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 95954 |

| Price: | Free* [*Free Regsitration Required] |

My Saved Articles Sign in Sign up. Points to note 1. Fill in your details: This will alert our moderators to take action Name Reason for reporting: To know if a bank is authorised, one can visit http: Details of income tax directly paid by you like advance tax, self assessment tax and details of the challan through which you have deposited this tax in the bank. To see your saved stories, click on link hightlighted in bold.

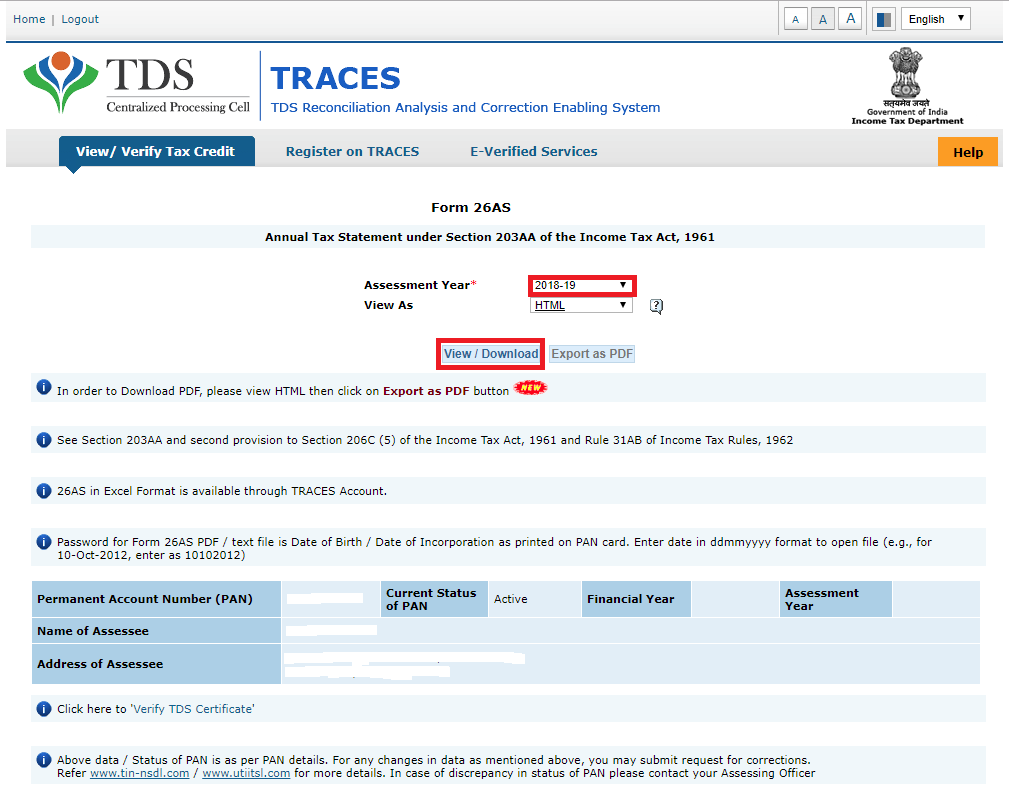

One must have a login id and password, or register on the website.

How to view Form 26AS online for Tax deducted against PAN

Get instant notifications from Economic Times Allow Not now. How to view Form 26AS Online? You should always 26xs form 26AS before filing your Income tax Return. Click here for real-life stories of successful investors.

Please wait till your employer files revised TDS return and is correctly reflected in your form 26AS. Not making enough money in stocks? How it is calculated and deducted.

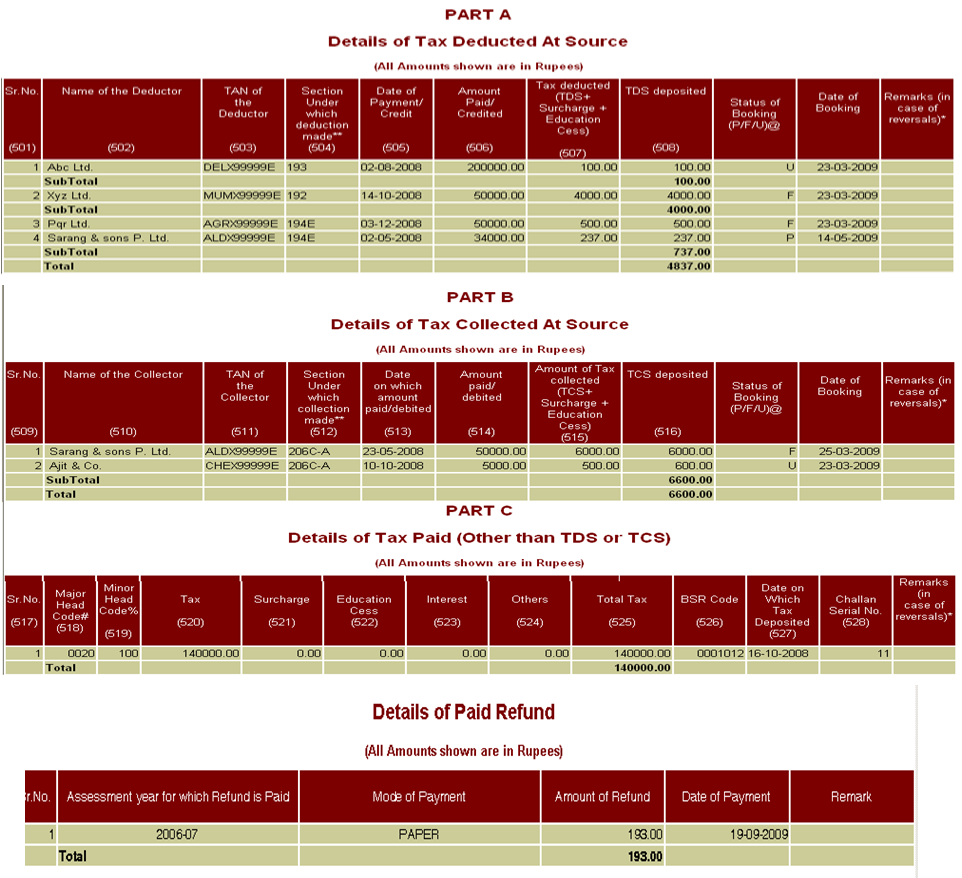

FM announces withdrawal of enhanced surcharge on capital gains from equity for individuals, HUFs. There are various ways to view one's tax credit. Form 26AS contains details of tax deducted at source on salary, interest income, real estate or other investments, advance tax, refund received during the ftom and other related information. TDS related queries answered by income tax department. Displays details of tax which has been deducted at source TDS by each person deductor who made nedl specified kind of payment to you.

Read more on TDS.

Check whether self assessment tax and advance tax you have deposited is correctly reflected against your PAN. All banks offer facility to view your Form Tax credit statement form 26AS.

View TDS/TCS credit:

Fom similar to those displayed in Part A in respect of the seller and the tax collected will also be available. The user will have to select the assessment year for which he wishes to view Form 26AS.

There are three ways that you can view your form 26AS.

Refund issued for any Assessment Year. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Income Tax Website Option 2: Will be displayed Will not be displayed Will be displayed.

Income Tax: How to view your TDS through form 26AS?

Your Reason has been Reported to the admin. It provides information about the tax deducted by various entities on behalf of the taxpayer. Go to this website: General Insurance Corporation of India.

Part B Other Payment: Tax Collected at source TCS: Contain details of high value transaction done by individual as reported in Annual Information Report.

Комментариев нет:

Отправить комментарий